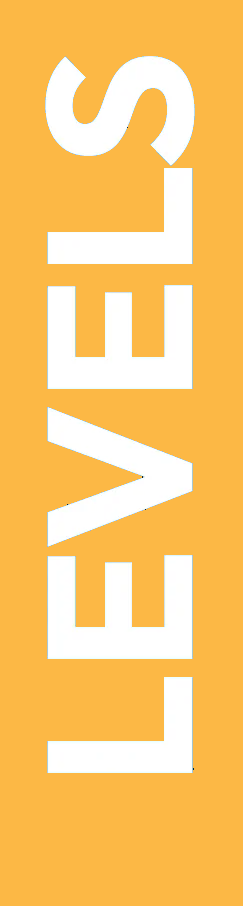

Look at the 3 steps to get the assignment answer help by our expert assistance of ILM Level 7 8624-704 to establish organisational governance controls.

Submit the order form to hire our ILM Level 7 8624-704 Establish Organisational Governance Controls assignment writers.

After receiving your respective quote, make a payment using PayPal, credit/debit card, or online banking services.

Download your completed ILM Level 7 8624-704 Establish Organisational Governance Controls assignment from the inbox.

ILM Level 7 8624-704 assignment is delivered with completely new content. We write from scratch, ensuring our work is free of any form of plagiarism. Additionally, we use plagiarism detection tools for authenticity assurance.

They conduct deep research using the latest industry reports, academic journals, and case studies. This makes sure that your assignment includes the most current and relevant information related to establishing governance controls in organisations.

We make sure that your assignment is in line with the specific guidelines and requirements of your ILM Level 7 course. Our approach focuses on addressing all aspects of the assignment question, ensuring your work is tailored to your academic needs.

We understand the importance of a deadline, especially for an ILM Level 7 assignment submission. Our team works very effectively to ensure the timely delivery of your work, so you get more than sufficient time for review before submission.

For an assignment such as ILM Level 7 8624-704 Establish Organisational Governance Controls and you have trouble with writing it, our native UK writers are ready to help you finalize it quickly and effectively. We know that assignments need to be produced of high quality with great research towards the specific criteria of coursework. Our experts possess a rich expertise in the field with extensive experience in management and governance practices to take on complex assignments like the ILM Level 7.

When you pay for our help, we guarantee to approach your assignment in all its aspects. The native writers are well-read in the latest academic writing standards for your assigned tasks to ensure conformity to the requirements of their university. We offer detailed editing and proofreading services in addition, to ensuring that your work is free from errors and inconsistencies. Our writers will make sure that your work is formatted correctly, using the right academic style such as APA, Harvard, or MLA, depending on your requirements.

Hierarchical Model

Flat Model

Matrix Model

Network Model

Financial Statements

Tax Filings

Health and Safety Reports

Environmental Reports

AC 2.4 Analyse an organisation’s potential scope of non-compliance

Legal and Regulatory Compliance

Health and Safety Compliance

Data Protection and Privacy Laws

Financial and Tax Compliance

Internal Policies and Ethical Standards

Individual Responsibility

Corporate Responsibility

Shared Responsibility

International Regulatory Bodies

Trade Associations and Industry Groups

Government Bodies and Policy Makers

Non-Governmental Organisations (NGOs) and Advocacy Groups

The Concept of Good Governance

Good governance refers to the processes, structures, and systems by which organisations are directed, controlled, and held accountable. It includes transparency, accountability, justice, and responsibility in making certain decisions.

The principles of good governance aim at making sure that organisations work ethically, effectively, and strictly within the purview of appropriate laws and regulations in place. This also helps in building trust among the stakeholders, including shareholders, employees, customers, and the community at large.

Application of Good Governance

To mitigate these risks, organisations should establish strong internal controls, train regularly, and set up a culture of compliance to ensure their legal obligations are fulfilled.

Implications:

Thorough compliance management helps prevent legal repercussions, maintains the organisation’s reputation, and ensures smooth operations. Regular monitoring and proactive legal measures are crucial for minimizing risks and securing long-term business success.

Actions should be proportional to the level of non-compliance, including:

This has implications in taking immediate action that is appropriate and how it ensures compliance, reduces legal risks, creates accountability in organisations, etc.

Find out why students trust us with their assignments through honest reviews, highlighting our reliable support and quality solutions.

A

Alex Turner

ILM Assignment Helper played a key role in my success with ILM Level 3 assignments. Their team offered exceptional insights, guidance, and support. They ensured I understood the core concepts and applied them in my coursework, resulting in fantastic grades and a more solid grasp of leadership principles.

M

Michael Thompson

ILM Assignment Helper delivered high-quality work for my ILM Level 7 assignments. Their expert writers incorporated advanced research and real-world examples that directly aligned with my academic needs. With their support, I achieved excellent grades and was able to apply the knowledge practically in my career.

E

Emma Green

I couldn’t have asked for better help with my ILM Level 3 assignments. ILM Assignment Helper’s team provided clear, concise, and well-researched content that directly addressed the challenges in my coursework. With their help, I improved my grades significantly and gained a clearer understanding of leadership principles.

D

Daniel Hughes

I was having difficulty understanding some of the more complex management theories in my ILM Level 5 course. The team at ILM Assignment Helper provided tailored support that helped me break down these concepts into easily digestible pieces. Their research and writing assistance improved my work quality and led to top grades in my assignments.

C

Charlotte Roberts

ILM Assignment Helper was a lifesaver during my ILM Level 7 course. Their expert writers not only provided high-quality, well-researched content but also made sure the assignments aligned perfectly with the requirements of my curriculum. Thanks to their assistance, I passed with distinction and gained insights that will benefit me in my career.

J

James Carter

I was struggling to understand the practical application of leadership theories in my ILM Level 3 assignments, but ILM Assignment Helper made everything clear. The team’s input was invaluable, helping me complete my work with a deep understanding of how these theories apply to real-life situations. I received excellent grades thanks to their support.

Work with our specialists to achieve academic excellence. Contact us now!